118金宝搏app

118bet金博宝

单号金宝搏188是正规的吗

3135硅胶高温线

3239硅胶高压线

118bet金博宝下载

3132硅胶电子线

3530硅胶线

3512硅胶电缆

118金宝搏

H05S-F硅胶线

188bet体育在线注册

硅胶加铁氟龙高温线

焊台手柄线

硅胶排线

医疗硅胶线

食品级硅胶线

硅胶数据线

陶瓷硅胶线

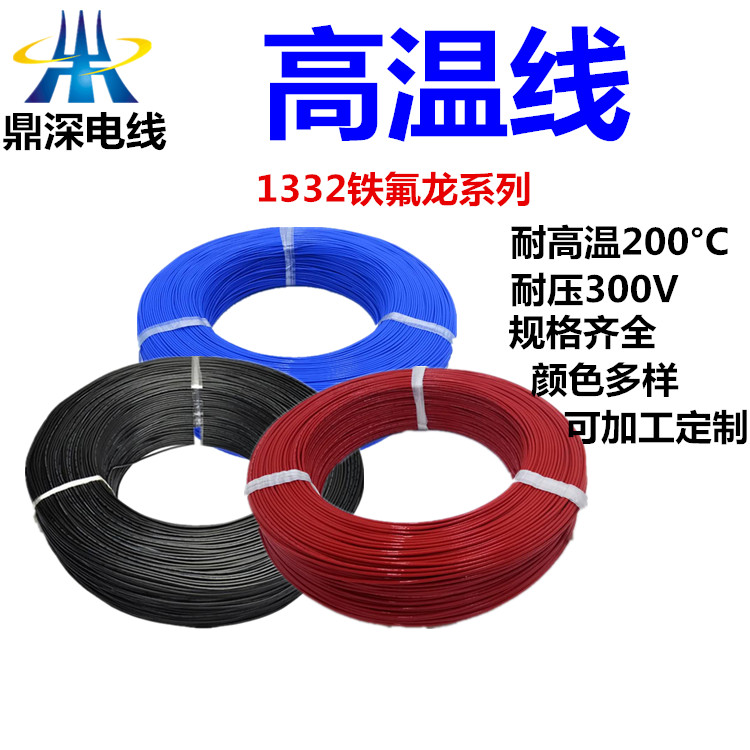

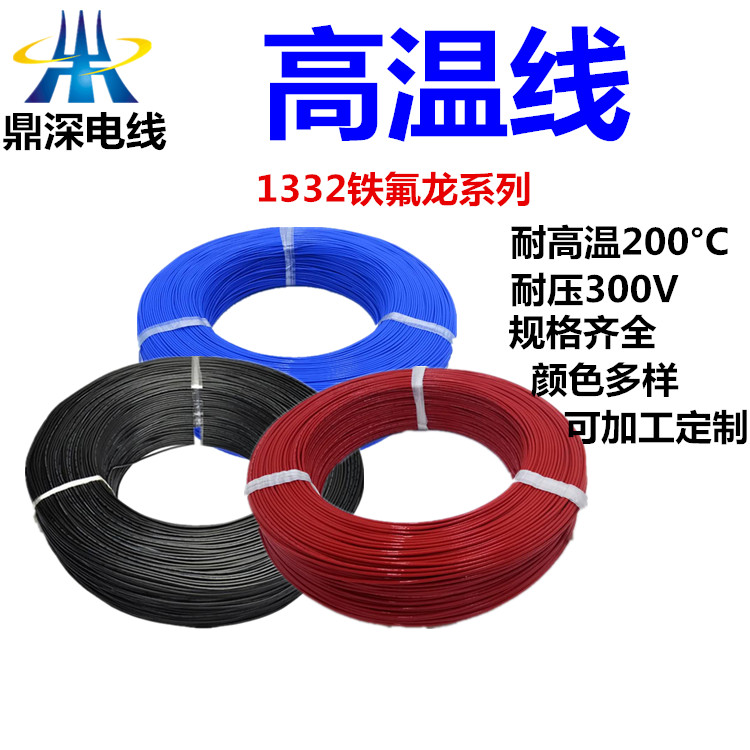

1332铁氟龙高温线

10064铁氟龙电子线

FEP铁氟高温线

250度铁氟龙高温线

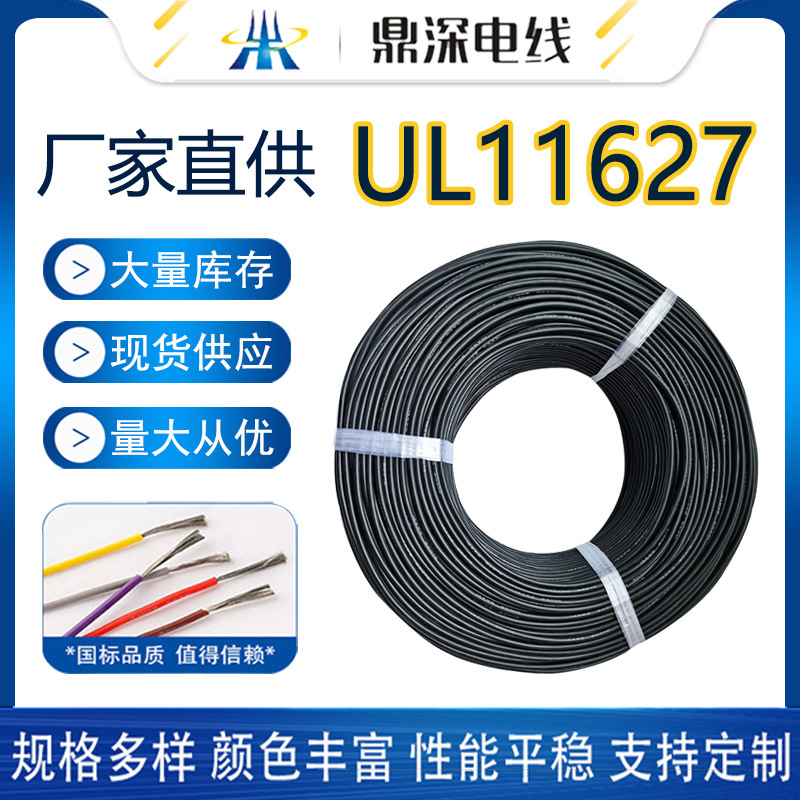

1007电子线

1015电子线

1569电子线

1571电子线

2468蓝(红)白排线

2464多芯线

3266无卤电子线

3302无卤电子线

3385无卤电子线

3173无卤电子线

电池连接插头线

TX系列端子线

香蕉头连接线

剥皮上锡引线

动力插头线束

普通端子线

线束加工

红黑硅胶双并线

硅胶护套线

VDE硅胶线

1430电子线

188bet金宝搏相关网站下载

- 金宝搏亚洲登录188宝

自动沾锡机械

自动沾锡机械

铁氟龙押出机械

铁氟龙押出机械

硅胶押出机械

硅胶押出机械

低烟无卤押出机械

低烟无卤押出机械

800悬臂单绞

800悬臂单绞

630悬臂单绞

630悬臂单绞

500高绞机械

500高绞机械

9寸混炼机械

9寸混炼机械

950机械

950机械

鼎深前台

鼎深前台

公司厂房

公司厂房

无卤押出机

无卤押出机

荣誉证书五

荣誉证书五

荣誉证书四

荣誉证书四

荣誉证书三

荣誉证书三

荣誉证书二

荣誉证书二

荣誉证书一

荣誉证书一